There Is a Plan B, There ALWAYS Was!

Now that bailout has been passed, we know it did not solve anything. It could even trigger hyper-inflation, and it may be begun to bring down the whole banking system. Many people inside Washington and on Wall Street know perfectly well that there IS a Plan B. A three-step solution, which begins with FDR-style bankruptcy reorganization, rather than hyperinflationary bailout. The first thing that must be done is to the pass the Homeowners and Bank Protection Act (HBPA), see below. This viable proposal has been out there since Sept. 2007, and everyone serious, who has studied it, knows it will work. Had Congress shown the guts to pass the HBPA in 2007, this crisis would have been averted, and we would have already been on the road to a new, viable international financial order.

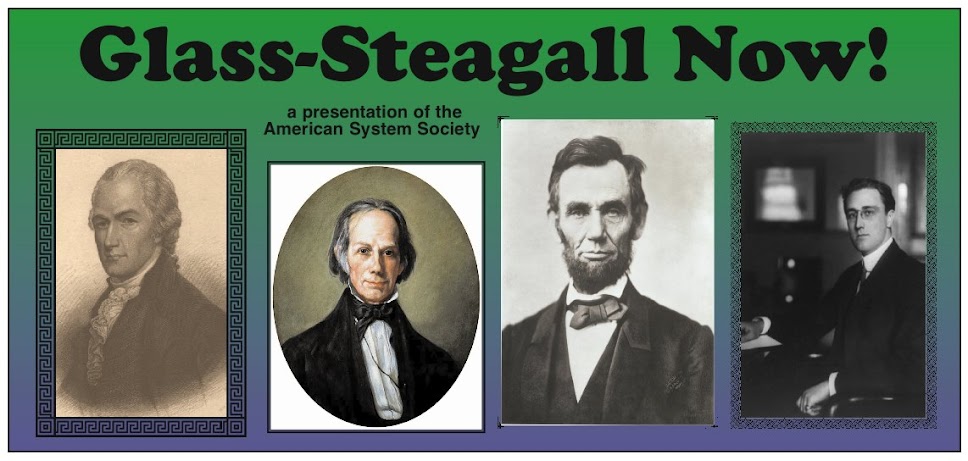

We are beginning to finally understand that properly regulated banking is an essential aspect of any economy, and we must save the state- and Federally chartered commercial banks and thrifts. That means two things: First, we must extract the relevant banking functions from banks which have often become virtual casinos of speculative bets, and second, we must restore the modern regulatory regime established by FDR, beginning with the restoration of Glass-Steagall.

The Glass-Steagall Act of 1933 was one of the most important banking regulations ever passed, as it prohibited any commercial bank from engaging in investment banking activities. As FDR told the House of Morgan, you can be a commercial bank or an investment bank, but you can't be both. This was done to prevent a raft of abuses which occurred in the 1920s and early 1930s, as the bankers saved themselves at the expense of their customers and the public. Glass-Steagall forced the House of Morgan to split into two separate institutions, an act for which FDR has never been forgiven, but FDR was entirely correct, as recent events have demonstrated. The banks began to chip away at Glass-Steagall in the 1980s, and it was finally repealed in 1999, after the illegal merger of Travelers and Citicorp to form Citigroup in 1998. The repeal of Glass-Steagall opened the floodgates as the banks expanded their speculative activities, until the distinctions between commercial banking and investment banking have virtually disappeared. As has the solvency of the system.