by Elliott R. Morss

Morss Global FinanceIntroductionAfter all the hype Margin Call received, I expected more. In my view, the movie was a real disappointment: it said virtually nothing about the banking crisis: just a bunch of people I can’t feel sorry for losing their jobs. And on that theme, how about the millions of people who lost their jobs because of the foolish and destructive things the bankers were doing?

After seeing the flick, I read some of the reviews. They were positive, with the emphasis on how entertaining the movie was. OK: the primary aim of movies is to entertain. But I think a movie providing a more complete picture of what happened could be even more entertaining than Margin Call. I offer an outline of such a movie below.

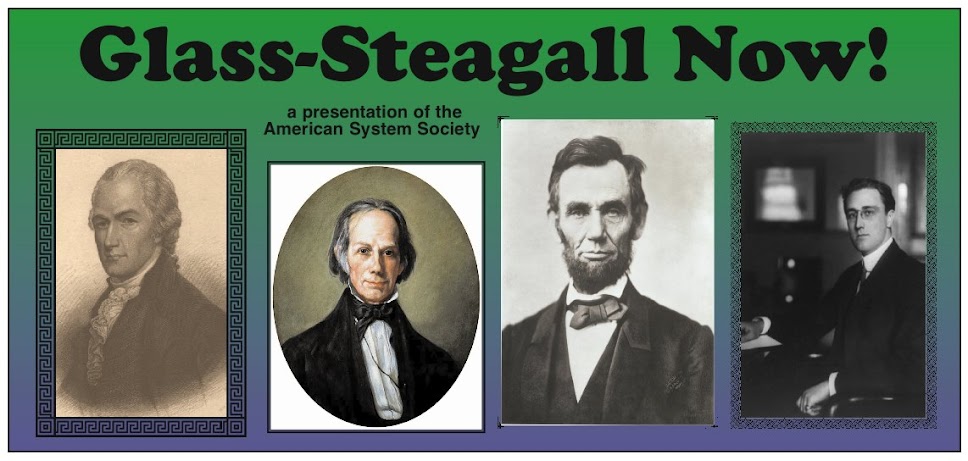

Scene One: 1933 – Glass-Steagall Act Enacted

The movie would start with an actor playing Senator Carter Glass arguing for passage of the Glass-Steagall Act. Glass, a former Treasury secretary and the founder of the U.S. Federal Reserve System, was the primary force behind the Act. Glass would explain why trading activities were too risky for banks and why the “investment banking” activities of banks had to be split off.

Scene Two: 1998 – Glass-Steagall OverturnedIn the next scene, we would again be in Congress – this time for the repeal of the key provision of the Glass-Steagall Act. An actor playing Sandy Weill would lead off. Sandy owned Travelers, which owned Salomon Smith Barney, and he was arranging a merger with Citicorp. But Citicorp was a bank and Salomon was an investment bank – not a legal merger under Glass-Steagall. So the lobbyists go to work for Weill. In the following year, Congress passed the Financial Services Modernization Act of 1999, known as the Gramm-Leach-Bliley Act. This law effectively deleted the prohibition on commercial banks owning investment banks and vice versa.

An actor playing Treasury Secretary Larry Summers should then say what Summers was quoted as saying: ”Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century. ‘This historic legislation will better enable American companies to compete in the new economy.”

Scene Three – Efforts to Regulate Derivatives

Shortly later, Summers teams up with U.S. Securities and Exchange Commission Chairman Arthur Levitt, Fed Chairman Greenspan, and Secretary Rubin to torpedo an effort to regulate the derivatives market. Actors playing Greenspan and Leavitt should concede, as they have publicly, that this was a big mistake. Summers should be quoted as well on his back peddling in saying that not regulating AIG’s financial insurance activities was outrageous.

Scene Four – Changing Bank Objectives

The scene should switch to a single bank. But instead of focusing on the market collapse and lost jobs (Margin Call), the first scene should be the bank president telling the troops that the time for holding onto (and worrying) about their own loans was over: the future was in writing up and selling off as many loans as possible for commissions. Traders would then buy them back, package them, and sell them off again.

Next the new bank hires: instead of green eye shade people worrying about loan quality, aggressive salesmen to sell bank mortgages and other loans would be brought in. And young MBA types to develop derivative packages would also be recruited.

Portraying this change in bank objectives and incentives is fundamental to understanding the reasons for the Western banking collapse.

Scene Five – Bank Insurance

It was not just AIG that sold insurance on mortgage-backed securities. Banks did as well. This could be captured in a short scene where a bank “seller” tells his boss that one of their major clients is showing some reluctance in buying a mortgage-backed security package. His boss responds: “tell the client the bank will insure the package”.

Scenes Six & Seven – Loss of Mortgage Documentation

The loss of mortgage documentation is critical, both for understanding why the mortgage-backed securities market collapsed as well as why finding ways to help mortgage recipients failed. On the former, more than 90% of mortgages are performing well. Why, then, would the whole market collapse. Lack of documentation – nobody knew where the bad mortgages were. These points can be captured in two related scenes.

First, a scene focuses on the packaging process where two bank staffers talk about keeping or not keeping accurate documentation trails on mortgages being packaged. The scene should end with them agreeing on taking shortcuts. A good final line might be “I am sure if we asked Joe in the buying department, he would have no documentation on the mortgage derivative packages he is buying.”

Second, a scene where the bank president calls in his mortgage packagers/buyers/sellers and said I want to sell off all our non-performing loans. The buyers and packagers would then say “we have no idea which mortgages in our derivative packages are performing and which are not”.

Scene Eight – The Market Collapse

We are now at the point where Margin Call started. The real estate market starts down, banks want to sell of the mortgage-backed security packages, but nobody knows where the 90% good mortgages are, so the whole market tanks. And because nobody knows where the bad mortgages are, all MB holders become suspect. So banks won’t lend to one another…. A real quote from a Senator following a briefing with Treasury Secretary Paulson could set the stage. This could be followed by a series of panic calls among bank salesmen.

The AIG Bailout

The AIG bailout warrants a movie of its own. However, as an end to the moving I am proposing, I offer the following.

Scene Nine – Early September Phone Call

Lloyd Blankfein, the man who replaced Paulson as the head of Goldman, calls the now Treasury Secretary Paulson. Blankfein: “We need the insurance money AIG owes us immediately.” Paulson: “I will see what I can do.” Paulson calls Tim Geithner, the head of the Federal Reserve Bank of New York. Paulson: “I want you to lend AIG $85 billion so it can make insurance payments to banks.” Geithner: “OK. Let’s arrange a meeting with AIG”.

Scene Ten – The Mid-September MeetingIn mid-September 2008, Secretary Paulson and Geithner met with senior executives of AIG and the Bank’s headquarters in New York. Guess who else shows up at the meeting? Lloyd Blankfein. Geithner asks Paulson why Blankfein is there. Paulson says “because I asked him”. Geithner agrees to lend AIG $85 billion. Ultimately, the government pledged $182 billion to save AIG.

Scene Eleven – November 2008 – Pay Full Value

In the October-November 2008 period, claims against AIG mounted. Inasmuch as AIG was effectively insolvent without massive government backing, senior AIG staff believed it could settle claims at 60 cents on the dollar and were prepared to move ahead on that basis. Paulson said “No. Pay out 100 cents on the dollar”.

Scene Twelve – Attempted Cover-up

Geithner holds a meeting with AIG and says: “in your next report to the SEC, do not name the banks that you paid.” AIG official responds: “I doubt the SEC will accept a statement that does not include the names of recipients getting more than $1 billion from us.” Geithner: “try it.” On December 30, 2008, Jeffrey P. Riedler, Assistant Director of the SEC, send a letter to AIG requesting the details on who got paid. Geithner was able to keep the names from being released until March 15, 2009.

The movie ends with the following Table.

AIG Payments (in billions)

Goldman Sachs .... 12.9

Societe General ... 11.9

Deutsche Bank ... 11.8

Barklays ... 7.0

Merrill Lynch ... 6.8

Bank of America ... 5.2

etc.

Total ... $93,200,000Source: AIG

ConclusionIn my humble view, this would make a great movie.

But until I get a call from Harvey Weinstein or Oliver Stone, the best movie on the banking collapse is Charles Ferguson’s “Inside Job”.